Renters Insurance in and around Lancaster

Your renters insurance search is over, Lancaster

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Lancaster county

- Lancaster area

- east petersburg

- willow street

- columbia

- lititz

- leola

- conestoga

- millersville

- pennsylvania

- lampeter

- manheim

- mountville

- strasburg

- ephrata

- reading

- lebanon

- central PA

- Philadelphia suburbs

- mt joy

- elizabethtown

- quarryville

- pequea

- gap

Home Sweet Home Starts With State Farm

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or apartment, renters insurance can be the right decision to protect your personal items, including your coffee maker, tablet, tools, desk, and more.

Your renters insurance search is over, Lancaster

Coverage for what's yours, in your rented home

State Farm Has Options For Your Renters Insurance Needs

Renting is the smart choice for lots of people in Lancaster. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance could cover the cost of an abrupt leak that causes water damage or smoke damage to the walls, that doesn't cover the things you own Finding the right coverage helps your Lancaster rental be a sweet place to be. State Farm has coverage options to align with your specific needs. Fortunately you won’t have to figure that out alone. With personal attention and fantastic customer service, Agent Alicia Alexander can walk you through every step to help you helps you identify coverage that secures the rental you call home and everything you’ve invested in.

There's no better time than the present! Reach out to Alicia Alexander's office today to talk about the advantages of choosing State Farm.

Have More Questions About Renters Insurance?

Call Alicia at (717) 393-4777 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

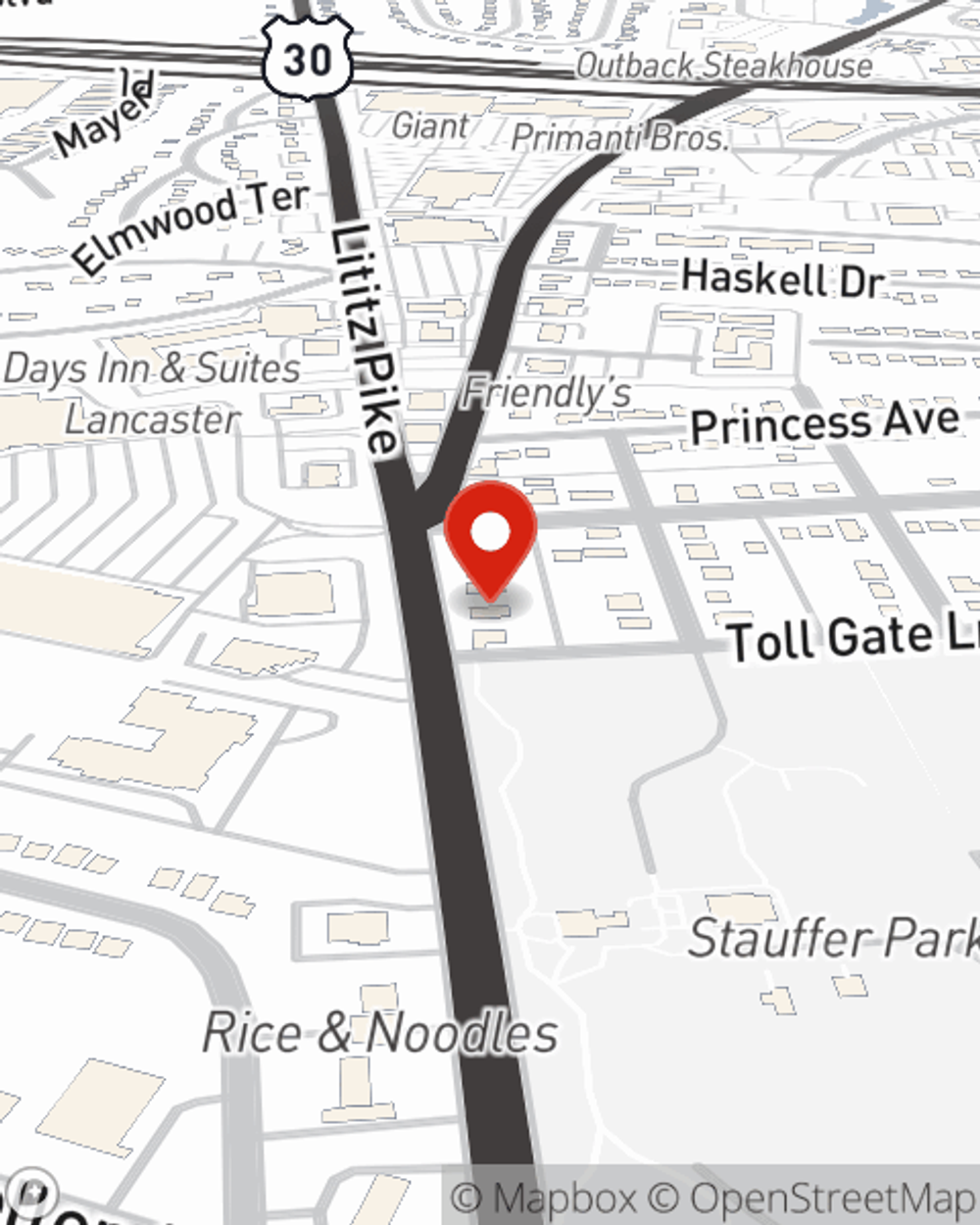

Alicia Alexander

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.